I live in a city that has among the highest auto insurance rates in California. Knowing this ahead of time, I was still shocked to see my insurance premium double when it came time to renew my policy. I was determined to find a better insurance company before my current policy expired.

I researched all the major insurance companies and received quotes that were deceivingly false. The quote I was shown online was for a certain amount per month, then when I called to speak to an agent, somehow the quote was quite a bit higher! Needless to say, this was beyond frustrating and I was not going to fall for their bait and switch.

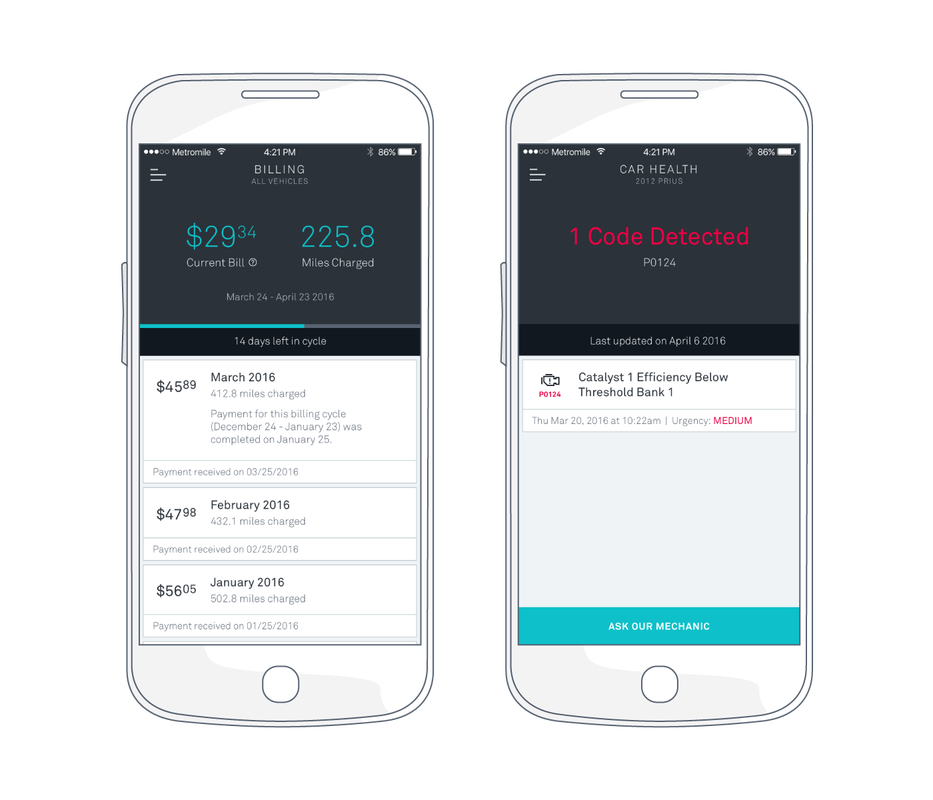

I did more research and found Metromile, they are a different kind of car insurance, they only charges you based on the miles you drive, putting you in control of how much you pay. I only drive approximately 300 miles per month, my average cost per month is about half of what my previous insurance was.

Some people might have reservations about installing the Metromile Pulse device on their vehicle. I personally don't have a problem with this, anybody on social media already has their data exposed to the social media companies already. This company and others like them is an industry disruptor on how traditional car insurance has been operating. The future for auto insurance and insurance in general will continue to shift. If you drive less than 200 miles a week you could save a ton of money on car insurance. I recommend you try Metromile as an affordable and frugal auto insurance option.

Disclosure: This post contains a refer-a-friend reward if you choose to sign up via my referral link.

RSS Feed

RSS Feed