by Jessica Cooper

After what we can all agree was the collective horror that was 2016, it would be nice to look forward to 2017 with optimism. The saying 'there is no time like the present' has never been more apt or important than it is now. Taking control of your finances and making 2017 beneficial to you will be a great move to kick start you into this year.

As with everything, it will be a bit of trial and error to see what ways can benefit you personally when it comes to getting the best our of your finances in 2017, but there are a few common things you can try to give your income a much needed boost.

Get savvy and say good-bye to eBay

Although eBay is the largest online marketplace in the world, a lot has happened since the simple selling site started, and there are many hidden fees for things like shipping and just selling in general that can be inconvenient. If you are looking for a quick way to get rid of unnecessary junk, there are other selling sites springing up now that make it a lot easier. Sites like Shpock and the app LetGo let you sell online much like you would a garage sale. When the weather is warmer, you can also think about actually doing a garage sale. Although it's an early start, you'll be surprised at how much you can make just having a de-clutter.

Save money on energy bills

If you are trying to have a more financially successful year, then saving money is going to be as good as making money. There is a reason so many comparison sites are becoming successful, and that is because people really are saving on energy bills. Most energy companies know for a fact that their customers would rather just plod along on the current contract than go through the hassle of changing it - but if you challenge this you could save yourself some pennies.

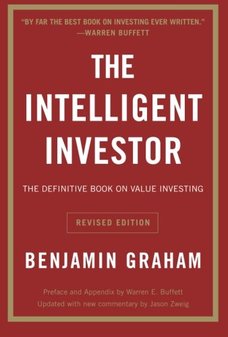

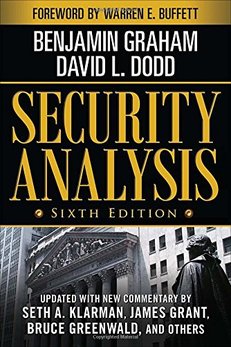

Online trading

When we think about trading stocks and shares, mere civilians think of incredibly confusing graphs, men with shirt sleeves rolled up screaming into the phone and risky investments. This isn't the case in the current market anymore. Ordinary people can now get a piece of the pie thanks to websites like CMC markets. Not only do they make trading accessible to the 'average Joe' (or Joanna), but they also have handy tips and tricks to help you along. You can invest a lump sum, or set up a direct debit, which is a great way to spread your risk over the months.

Make money online

Back in the day when there were 'pop-ups', making money online was one of the more popular ones. Unfortunately, this usually led to needing to sign up to countless amounts of websites and completing a million paid surveys for $1.00. Now there are a lot more options for supplementing your income online. If you are a bit of a budding David Bailey, there are many websites that let you sell your original photos online, and if you love writing, you can sign up to a content website and let those creative juices flow.

Stop buying lunch

Coming home from work and making a filling, healthy lunch is probably most people's nightmare. However if you actually do the numbers, it's scary how much a $5 meal deal every day can set you back. It may only be $35 per week, but that is still $140 per month. $140 may not seem like the biggest deal, but when you put that into the perspective of it covering one bill per month, it will really help you become better off.

Try and incorporate foods that you can make lunches with into your weekly shop. If you prefer a hot meal, prep in advance and make yourself an army of jacket potatoes to be getting on with. Homemade doesn't have to mean boring, and if you really are stretched for time of an evening, make a bit of extra dinner to take the next day. If you really do miss your lunches, set aside a day a month where you have the time and money to go out for a little treat.

Jessica Cooper is a content writer on the Blue Anchor team, covering topics relating to money, investing, business and finance. She specializes in online article copywriting and has produced work for countless blogs over her 2 years of writing for the online community. She has a particular interest in psychology and behavior when it comes to people and money and enjoys looking to the past for lessons that can be learnt from history.

RSS Feed

RSS Feed