There must be countless ways to save (and make) money, I've listed some of my favorite ways here:

1. Use Cash - most people tend to spend less when paying cash vs. a credit card or even a debit card. As an added incentive, some retailers, such as gas stations - offer discounts to cash paying customers in order for them to save money on high bank merchant fees.

2. Pay Bills Online - sign up for auto payments online to pay your bills. Not only will you save money on postage stamps and checks, but it also ensures that your payment is not late - avoiding those pesky late fees! Tip - I always pay off my credit card statement balances each month.

3. Earn Rewards When You Shop - whether it's buying groceries or stocking up on items online or offline, I make sure I am using the appropriate credit card to maximize my cash back earnings! Since I'm spending money anyway, why not get a rebate on my purchase. Two of my favorite cash-back shopping portals are Mr.Rebates and BeFrugal - both offer cash-back rewards for shopping online.

4. Wash Clothes In Cold Water - this will save you money on energy costs and your clothes will come out just as clean. Make sure you are doing a full load, to save even more energy.

5. Do-it-yourself beauty regimen - why pay a professional if you can do it yourself? I personally dye my own hair, give myself the occasional manicure & pedicure and masque facials.

6. Split Your Meal - save money by splitting an entree (with or without an appetizer or salad) with another person. The bonus is that you won't be tempted to overeat and maybe even lose some pounds. Whenever you go out to restaurants, there are other creative ways to save money when dining out.

7. Save Leftovers - don't just reheat your leftovers, get creative - add other ingredients to make a whole new meal. My personal tip - most leftovers taste better with butter, garlic and onions!

7. Shop Thrift Stores - check out flea markets, swap meets, thrift stores, yard sales, estate sales for great and unique finds in clothing, accessories, furniture and home items for a lot less.

8. Grow Your Own - save money on herbs such as basil, cilantro, rosemary or lavender. Plant your own herb garden or potted herbs to add to salads and meals. Plant and grow your own vegetables & fruits too.

9. Recycle Gift Bags, Wrapping Paper, Ribbons - if it can be re-used, don't throw it away! I always recycle gift bags, tissues, bows, ribbons, etc.. from previous presents.

10. Homemade gifts - if you love to bake, make some yummy cookies or brownie and present it in a gift basket or tin. If you love photography, print out some photos of the recipient and place them in a set of inexpensive frames. You can also make a potted arrangement of succulents from your own garden.

11. Snap Up Coupon Deals - be on the lookout from daily deal sites such as Groupon. Redeem restaurant or other discount deals that you know you will really take advantage of. You can also get cash back when dining out.

12. Do-it-yourself Home Improvement Projects - tackle projects around the house, such as painting or basic landscape work, etc.. this saves a lot of money on professional services.

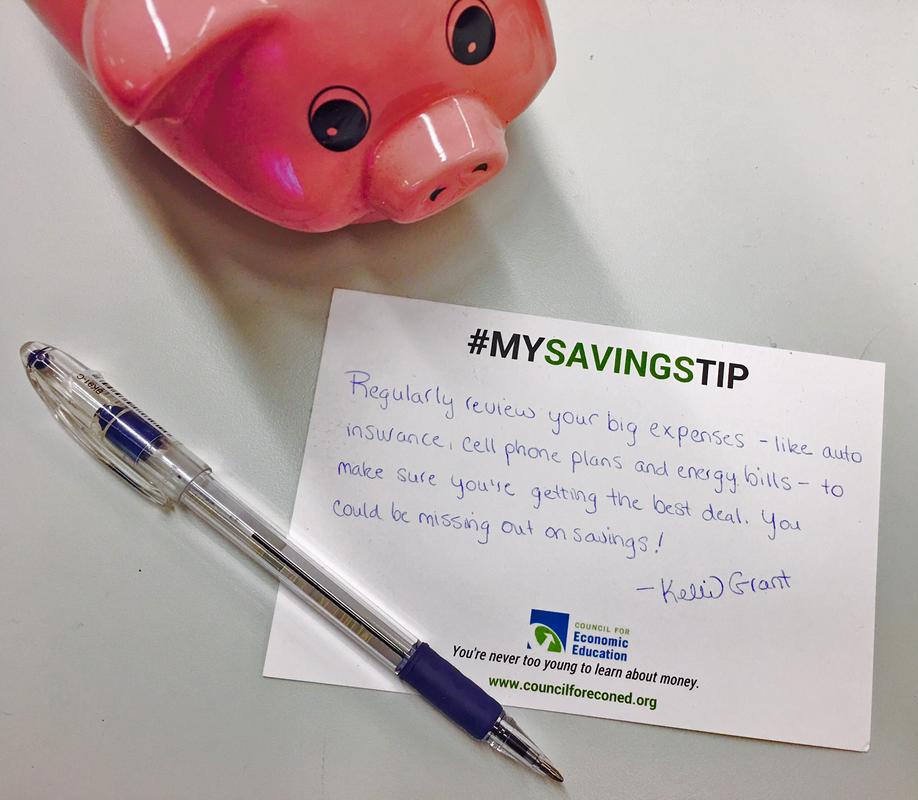

13. Save on Insurance Cost - if you are on the market for a new or pre-owned vehicle, consider purchasing an SUV, a pick up truck or even a mini-van. These types of vehicles usually cost less to insure than others. Another way I've saved money, is to shop around for a better deal before your policy expires.

14. Free Tire Air Checks - keep your tires inflated to maximize gas mileage, especially on long trips. Low tire pressure robs gas mileage - up to three miles per gallon! Get free air checks at tire centers such as Discount Tire stores. They have also rotated my tires for free.

15. Walk or Ride your Bike - instead of driving a few blocks to your destination, why not walk or ride your bike? It will save you money on gas and it's good exercise also!

16. Free T.V. - I watch my favorite TV shows on their respective network or on YouTube. Another great option is Tubi or Crackle. You can also go to your local library and borrow any available DVD's, usually 2 at a time.

17. Swap or Borrow - whether they are tools, magazines or books, you can swap or borrow them with friends. This concept also works for clothing and accessories you no longer wear or want.

18. Shop The Dollars Stores - visit your neighborhood dollar stores - such as Dollar Tree, Family Dollar, 99cent Only, Dollar General, Dollar King, etc.. to find great values on basic essentials.

19. Unplug Chargers - disconnect devices such as phone, computer, small appliance, and other chargers, from the wall when not in use. If the charger is plugged into the wall it is still on and consuming energy even if you aren’t charging.

20. Free Magazines - if you have miles that have accumulated in various airline rewards program but do not enough for airline tickets, redeem them for free magazines. I've subscribed to some of my favorite magazines, such as People, Cosmopolitan, Traveler, Architectural Digest, etc.

RSS Feed

RSS Feed